Low to moderate income taxpayers may be eligible.

Shutterstock photo

CINCINNATI - The United Way of Greater Cincinnati is offering free tax preparation and filing help for eligible citizens.

How Does It Work?

Visit one of United Way's tax sites to have an IRS certified tax volunteer prepare and file your return for free or file on your own.

There is no penalty to file taxes to claim these credits and they do not affect any benefits you are already receiving.

Who is Eligible?

Low-to-moderate-income taxpayers may be eligible for the free tax preparation and filing service, including those with disabilities and limited English-language abilities.

The 2025 Tax Season began on January 20 and runs through April 15.

For more information, visit uwgc.org/freetaxprep.

The Community Project Receives $1,000 Grant from DCF

The Community Project Receives $1,000 Grant from DCF

BCEF's Student Success Center Opens at Batesville High School

BCEF's Student Success Center Opens at Batesville High School

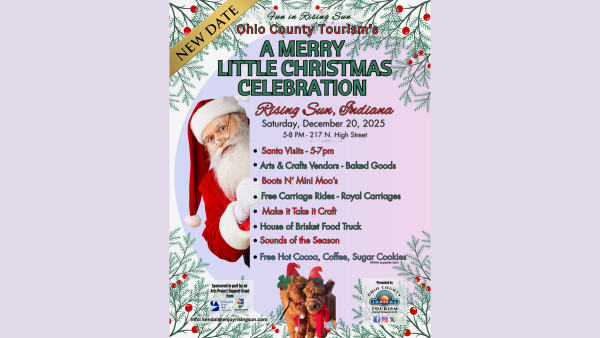

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Indiana Senate Rejects Redistricting Bill

Indiana Senate Rejects Redistricting Bill

OCCF Names Lilly Scholarship Recipient

OCCF Names Lilly Scholarship Recipient

Indiana FSSA Extends Open Enrollment for HIP and PathWays Plans Through December 24

Indiana FSSA Extends Open Enrollment for HIP and PathWays Plans Through December 24